1. What is academic misconduct?

Academic misconduct can sound intimidating, but understanding it is an important first step. It includes things like cheating, copying someone else’s work without properly referencing it, working with others when you’re not supposed to, or even paying someone to do your assignments for you. Sometimes it happens accidentally, like forgetting to cite a source or misunderstanding the rules. But here’s the thing: even if it wasn’t intentional, it’s still considered misconduct.

The good news is, you’re not expected to be perfect from day one. Institutions know that students are learning and growing, and they offer plenty of resources to help you understand what’s okay and what’s not. Saying you weren’t aware of the rules won’t excuse misconduct, but taking the time now to learn about the rules will help you avoid any trouble in the future. If you ever feel unsure, ask for help—it’s always better to clarify than to guess.

2. How is an academic misconduct case initiated?

If someone at your institution thinks something might not be quite right with your academic work, they’ll start a process to look into it. Don’t panic. This happens more often than you might think, and it doesn’t mean you’re automatically in trouble. Usually, it starts when a staff member notices something unusual in your assignments, exams or other academic tasks. They’ll then report it following the rules set by your institution. Remember, you’ll have the chance to explain your side of things and there are people and resources to help you through this process.

3. What are my rights during the academic misconduct process?

You have several important rights to help you through this process and it’s okay to feel overwhelmed—this happens to many students and you’re not alone. You have the right to bring a support person to help you feel more confident, the right to know exactly what the allegations are and the right to share your side of the story. Plus, there are resources available to guide you, including tools to help you prepare your case and even appeal a decision if you think it was unfair. Take a breath; there are people and steps in place to make sure you’re treated fairly.

4. How do I respond to an allegation of academic misconduct?

If you’ve been faced with an allegation, take a deep breath—it’s okay to feel nervous or even angry. The first thing to do is understand the details and think about whether the allegation is accurate. If you believe it’s true, it’s better to be honest and let the staff know. On the other hand, if you think the allegation isn’t correct, take your time to carefully review what’s being alleged. Gather anything that might help explain your side, like notes, emails or documents. You can then write a clear response or attend a meeting where you’ll get a chance to share your perspective. Remember, being truthful and expressing yourself clearly will go a long way. There are people who want to help you through this—you’re not alone in facing this challenge.

5. What happens if I am found responsible for academic misconduct?

If it turns out that you’ve engaged in academic misconduct, there will be consequences based on the seriousness of the situation. These might include a warning, failing an assignment or course or, in more severe cases, suspension or expulsion. Whatever the outcome, you’ll be informed of the decision and what steps you need to take next.

If you’re studying law and planning to become a solicitor in Australia, it’s especially important to note that academic misconduct can have long-term implications. To be admitted, you’ll need to prove that you’re a ‘fit and proper person’ and it’s required to disclose any academic misconduct to the relevant admissions authority. The board may decide to prevent admission as a solicitor if they believe the academic misconduct reflects poorly on your character or candour.

6. Can I appeal an academic misconduct decision?

If you believe the decision wasn’t fair, you have the right to appeal it. Think of it as a chance to share your side of the story again. Appeals can focus on things like mistakes in the process, new evidence you’ve found or anything that makes you feel you were treated unfairly. Keep in mind that you can’t appeal just because you’re unhappy with the outcome as it needs to be based on solid reasons. Write your appeal clearly, explaining your points and including anything that supports your case. It might feel daunting but remember, this is your opportunity to make sure everything is looked at properly and there are people who can guide you through it.

7. How do I prepare for an appeal?

Preparing for an appeal might seem overwhelming, but if you have grounds, take it one step at a time. Start by gathering all the important documents, like any evidence or notes that can support your case. If there's new information that wasn’t included before, make sure to highlight it. Then, write your appeal letter as clearly as you can, explaining what went wrong or why the decision might have missed something important. When presenting your case, focus on being truthful and confident. This is your chance to make sure everything is reviewed properly and you’ve got the opportunity to say what’s on your mind. Step by step, you’ll get through this.

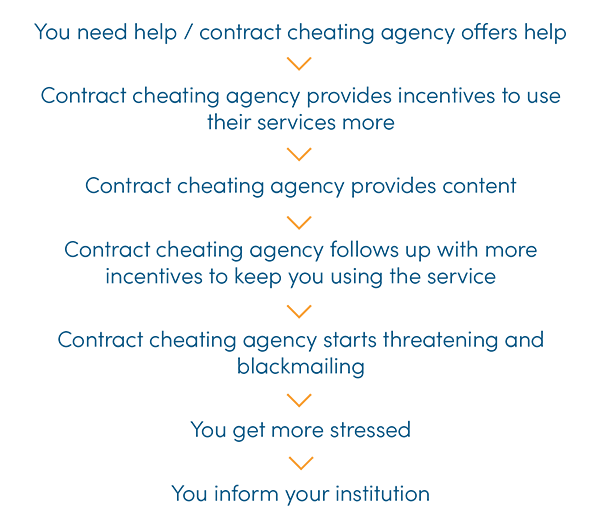

8. Can I use an external service to prepare my response for me?

It might seem like a good idea to use an external service to help with your response or appeal but it’s important to be cautious. These services may not fully understand your unique situation and their responses could end up feeling generic or not quite right. By preparing your response on your own, you can make sure your points are personal, specific to your case and truly reflect what you want to say. Institutions really value authenticity and a sincere effort, so taking the time to write your response or appeal thoughtfully can make all the difference. Focus on the specifics of your case, your reasoning and anything that supports your perspective. If you need help, don’t hesitate to reach out to the academic support staff or use the resources provided by your institution.

9. What resources are available to help me through this process?

There’s plenty of resources out there to help you through this, so start by checking your institution’s website. You’ll likely find the policies you need to understand the process and feel more prepared. Plus, don’t hesitate to reach out to the student support staff. They’re there to help and can make a big difference when you’re figuring things out.

10. What are my responsibilities during the academic misconduct process?

Your role is simply to be honest, stay engaged and follow the steps laid out for you. Respond to any emails or requests on time, share information clearly and cooperate with whatever decisions are made. It’s also important to stay respectful and keep things confidential. This helps keep the process smooth for everyone involved.

11. How is my academic record affected by an academic misconduct case?

Your institution must keep a record of the process, regardless of the outcome. If you’re unsure about whether anything will appear on your transcript or need more details about how your record is managed, your institution can explain all of that clearly.

12. Should I drop my course/unit of study if I receive an academic misconduct allegation?

You might feel tempted to drop a course after receiving an academic misconduct allegation. However, it’s important to know that even if you withdraw, the investigation will likely continue. The good news is that many students with a finding of academic misconduct in just one assessment still go on to successfully complete their courses. Don’t lose hope, stay engaged in the process and don’t let it distract you from your other studies.

13. Is this process confidential?

Institutions take great care to handle student records with confidentiality, ensuring that only authorised staff have access to sensitive information, and they follow strict guidelines, like those outlined in the Higher Education Standards Framework (Threshold Standards) 2021, to keep your information secure and accurate. This means you can feel confident that your academic history, including any cases of academic misconduct, is managed responsibly and with respect. When an allegation arises, it is documented in the student's file along with relevant evidence, communications and outcomes of the investigation, with access strictly limited to those directly involved in the process. You shouldn’t worry that outcomes will be used against you or that future academic staff will hold biases—unless there’s repeated academic misconduct, which might influence how your institution decides a penalty for repeated cases or offers support to you.